Since the early days of private equity, funds, mostly organized as Limited Partnerships, have traditionally compensated General Partners, representing investment firms, via a management fee, generally an annual 2% of the total committed capital, and a carried interest, typically 20% of the funds’ future profits.

While large and established investment firms generally remain very attached to management fees, we have in the recent years seen many smaller firms trying to gain a competitive advantage by waiving their management fees in exchange for a profit interest in the partnership.

Indeed, a fee waiver can be beneficial for both Limited and General Partners.

On the Limited Partners’ side, this practice is sought because it tends to show that the General Partner is confident and committed and that its interests are aligned with the investors. As long as the waiver is not used to offset all of the General Partner’s already existing cash commitments (in which case this practice is just a “trick” for the General Partner not to contribute to the fund out of its pocket) it shows that the General Partner has “skin in the game” since the General Partner is willing to put at risk an otherwise steady stream of income, regardless of the fund’s performance.

Simply put, it shows that the General Partner is confident in its own abilities. This matters immensely to Limited Partners that are about to entrust a General Partner with several million of their dollars and it makes a competitive difference.

On the General Partner’s side, this practice presents at least two other perks. First, from a mathematical stand point, because management fees are paid out of the total committed capital, they reduce the amount of capital actually invested in portfolio companies, which makes it harder to reach the level of return on investment sufficient to trigger carried interest payments. As a result, if the fund is successful, properly negotiated and drafted management fee waivers will increase the General Partner’s compensation, as well as the fund’s general performance. Second, with well crafted fee waivers, General Partners can benefit from a more favorable tax rate.

Most funds’ limited partnership agreements provide that proceeds are to be distributed as follows:

- First, to the Limited Partners until their capital contributions are fully repaid;

- Second, to the Limited Partners in the form of a preferred return or “hurdle”, usually between 6% and 8% of capital contribution (although we have recently seen more and more Limited Partners accepting to cut their hurdle rate);

- Third, to the General Partner, until it receives 20% of all distributed return on investment (the “carried interest” or “carry”);

- Fourth, 80% of any remaining balance to the Limited Partners, with the other 20% going to the General Partner.

Hence, before the General Partner receives any carry distribution, the fund has to repay all contributions to Limited Partners with an interest rate of 6% to 8%, which means that 100% of the proceeds will go to the Limited Partners until they receive $1,06 to $1,08 for each dollar contributed.

The above waterfall provision does not distinguish between capital contributions actually invested and contributions used to pay costs and fees. Indeed, capital contributions, whether invested or used for a different purpose, for instance, to pay management fees, must be repaid to Limited Partners (with interest) before the General Partner receives any share of the proceeds. Of course, it makes sense that more cash is invested in portfolio companies, more cash will be returned for each realized investment.

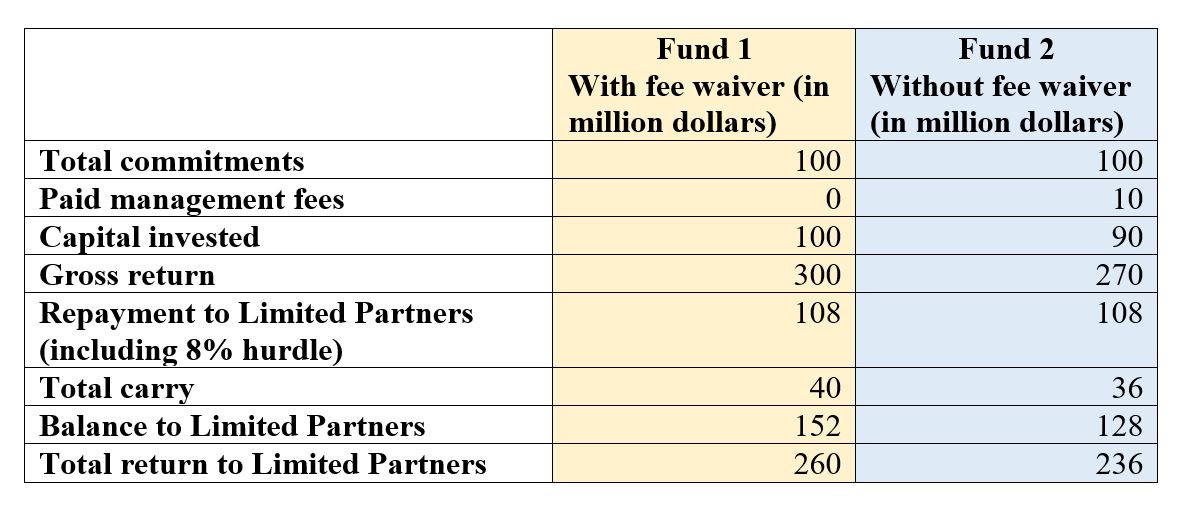

The following examples demonstrate how a General Partner waiving management fees can make up for the loss of such fees and maybe achieve better results:

- Let’s compare two funds that achieve the same gross return multiple, say 3. It means that for each dollar invested in a portfolio company, the fund makes $3.

- Each fund has $100 million in total capital commitments.

- In fund 1, the entirety of our $100 million was invested.

- In fund 2, a 2% management fee is paid out of the contributed capital and the General Partner will receive $10 million in management fees in the course of 5 years. As a result, only $90 million will be investable capital.

- The distribution waterfalls would work as follows:

As shown in the above table, the General Partner’s share of the distributions is $6 million higher in fund 1 than in fund 2. In addition, while fee waiver arrangements vary, the General Partner in fund 1 will typically have negotiated a larger share of partnership’s interest which will allow it to make up for the $10 million in waived fees. Fund 1 also provides for the 2% extra carried interest, which will provide the required $4 million to close the gap.

The result is a win-win for both Limited Partners and General Partners. The Limited Partners will have seen General Partners take more risk and the General Partners will achieve a higher return for their Limited Partners, which improves their record and makes them more attractive, while also giving them at least equal compensation.